The basic concept is simple: To help entrepreneurs with companies that have large market potential raise private equity.

Think of the ICC as a virtual incubator, where entrepreneurs and scientists can get assistance in perfecting and maturing their ideas and business concepts. At the core of their service is the ICC Process - a set of detailed steps and guidelines that help entrepreneurs refine their business strategy, financials, investor presentation, concept, and valuation. This detailed framework creates a professional business package for enterpreneurs which potential investors can use to quickly and easily assess their level of interest. The Process is built around well-defined steps that result in a solid business concept, valuation of the company, and investor presentation.

The ICC works through its six statewide offices to coordinate local efforts to aggregate investors, employees, mentors, service providers, and other resources throughout the Commonwealth. For the first time, entrepreneurs have open access to ideas, talent, and money. Deals are no longer limited by geography or regional contacts. Companies that follow the ICC standard become part of the "ICC Portfolio." These companies are then introduced to private investors.

The ICC works through its six statewide offices to coordinate local efforts to aggregate investors, employees, mentors, service providers, and other resources throughout the Commonwealth. For the first time, entrepreneurs have open access to ideas, talent, and money. Deals are no longer limited by geography or regional contacts. Companies that follow the ICC standard become part of the "ICC Portfolio." These companies are then introduced to private investors.

As an entrepreneur, ask yourself the following questions:

Does your company have a large market potential? ($25M to $50M)

Are you willing to work hard and take a serious look at your company?

Are you serious about starting a new economy business?

Do you understand the steps necessary for starting a business?

Do you have a competitive business plan or could you develop one?

The ICC Process was modeled after the best practices of other successful state programs and then tailored to meet the needs of Kentucky companies.

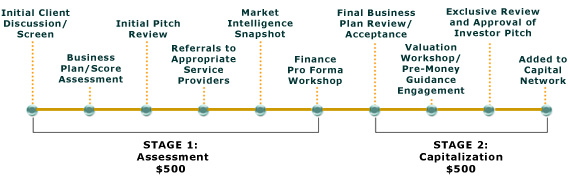

The Kentucky ICC Process has two stages.

Stage 1 focuses primarily on the creation of a competitive business plan, integrated financials, and an elevator pitch.

Stage 2 focuses on company valuation, investor pitch, and adding companies to the ICC's Kentucky Capital Network where qualified investors look at ICC client opportunities.

Between Stage 1 and Stage 2, the ICC will determine if the company possesses the qualifications to be a Stage 2 company. A company that completes Stage 1 but doesn’t qualify for Stage 2 in the ICC process is still armed with a much stronger business plan with which to enter into the marketplace.

The graphic below shows all the steps in Stage 1 and Stage 2. Click on the graphic for additional details about the ICC process.

Stage 1 focuses primarily on the creation of a competitive business plan, integrated financials, and an elevator pitch.

Stage 2 focuses on company valuation, investor pitch, and adding companies to the ICC's Kentucky Capital Network where qualified investors look at ICC client opportunities.

Between Stage 1 and Stage 2, the ICC will determine if the company possesses the qualifications to be a Stage 2 company. A company that completes Stage 1 but doesn’t qualify for Stage 2 in the ICC process is still armed with a much stronger business plan with which to enter into the marketplace.

The graphic below shows all the steps in Stage 1 and Stage 2. Click on the graphic for additional details about the ICC process.

Stage 1 focuses on the creation of a competitive business plan, integrated financials, an elevator pitch, and the development of critical business thinking skills.

The ICC will meet with you for one hour, at no charge, to evaluate your idea, technology/product, or process. In this meeting, the ICC staff will determine if you have an idea that is competitive and can be protected in today's market. Here are some of the questions you should be prepared to answer. More about Businesses Fail.

How would you describe your company?

Who are the company founders?

What problem is being solved with this new innovation?

What is the market and who are the customers?

What is the value proposition?

Is this idea unique? Can it be protected in the market? How?

Can you scale the product to the market?

What is your sales/marketing strategy?

Do you have any strategic partners to help you with this innovation? What is your relationship to them?

During this meeting, you and the ICC representative will determine if your business idea and potential fits the ICC Portfolio. If it appears that there is a match, you will be asked to join the ICC Process and complete a service agreement.

To proceed to this step, you will need to submit to the ICC a service agreement, your business plan, and payment of $500. The ICC staff will read your business plan, access a raw score and provide detailed feedback. In general, you can expect the ICC to look at the following:

The ICC will listen to your “elevator pitch." Your elevator pitch should describe your company and summarize your financial needs in about 1 minute. You should be able to adapt what you say to be more successful in interesting an investor or just explaining your company.

In some cases, the ICC office may refer you to a qualified service provider. For example, you may need someone to assist you with writing your business plan or to guide you with your financials. Other ICC clients need advice from a qualified patent attorney or the marketing expertise of a graphic designer.

Once the ICC staff has read your "successful" business plan, they will conduct basic market intelligence research. This will allow the ICC to determine if the business plan is accurate and if the competition has been adequately addressed. This basic market evaluation is extremely valuable. In one instance, it identified a competing product that left little or no room for competitive products. In other case, it identified market potentials that were overlooked by the company. If your company would like a more detailed market analysis, these can be provided for a fee. Additionally, at the company’s option, the ICC can have your technology reviewed by third party experts. A fee in the range of $1000-$2500 will apply for this service.

All ICC clients are invited to participate in a Financial Pro Forma Workshop. This workshop, conducted by the ICC Headquarters addresses why financials are important, what integrated financials are, how financials should be presented in a business plan, an introduction to term sheets, and an overview of valuation.

Stage 2 is optional for both the ICC Client and the ICC. Only clients with investor level concepts are eligible to participate. Stage 2 includes a workshop on how to determine the value of your company, guidance in how the ICC valued your company, and what you can expect to hear from investors based on this valuation. Moreover, clients enter “finishing school” where your formal investor pitch will be aggressively critiqued in front of investment-savvy ICC reviewers. In the final step, the client's portfolio will be added to the ICC's Kentucky Capital Network where it will be available for review by qualified investors.

Before moving to Stage 2 in the ICC process, you be notified by the ICC office that you have graduated to Stage 2. This means that your business plan is in good shape, the market of your product has potential, and, in general, they feel that your business has private equity potential. You will be asked to return to the ICC a Stage 2 service agreement and a Stage 2 fee of $500.

You will meet for a half-day session with Matt McGarvey, The Venture Finance Director of the ICC. Matt will guide the ICC client company in pre-money valuation in a one-on-one session. This session will prepare you to talk to investors about your company, discuss term sheets, and other topics.

You will present your business pitch to a panel of professional investors and the ICC staff who will be provided with feedback. They will ask you questions that you can expect to hear in formal pitch sessions with venture capitalists and other investors. This will allow you to fine-tune your presentation to investors.

Congratulations! If you have made it to this step, you have produced a competitive business plan and pitch. The executive summary of your business plan will be added to the Kentucky Capital Network. Their Fund.

The Kentucky Capital Network is comprised of individuals, VCs, clubs, and groups who have filled out an application and are known qualified investors. While they cannot promise deals, they do commit that qualified investors will have access to your business idea.

Investors may contact you on their own or through the Kentucky Capital Network. If the angel and/or the company want the ICC staff to be present at the meeting, and you agree to this, ICC staff will be happy to attend. If the angel prefers to meet with the company on their own, their staff will happily discuss the meeting with you when it is over.

The Kentucky Capital Network is not a brokerage and will not broker your deal with the investor.